tax on unrealized gains unconstitutional

Biden Is Trying To Pass a Wealth TaxAgain. Given the opportunity everyone would pay less and the government would still be complaining.

If Billionaire Tax Survives It May Face Legal Challenges Here S Why

An income tax that was imposed by the Revenue Act of 1916 on such a dividend was unconstitutional even if the dividend indirectly represented accrued earnings of the corporation.

. Answer 1 of 4. The 16th Amendment allows Congress to tax income The Congress shall have power to lay and collect taxes on incomes from whatever source derived. In light of the capital gains tax resetting from its 2003 levels to its pre-Bush levels Dr.

The tax laws include a 0 tax bracket on long-term capital gains up to a certain amount of total income. Under the proposed Billionaire. Rahn argued today that capital gains taxes impede.

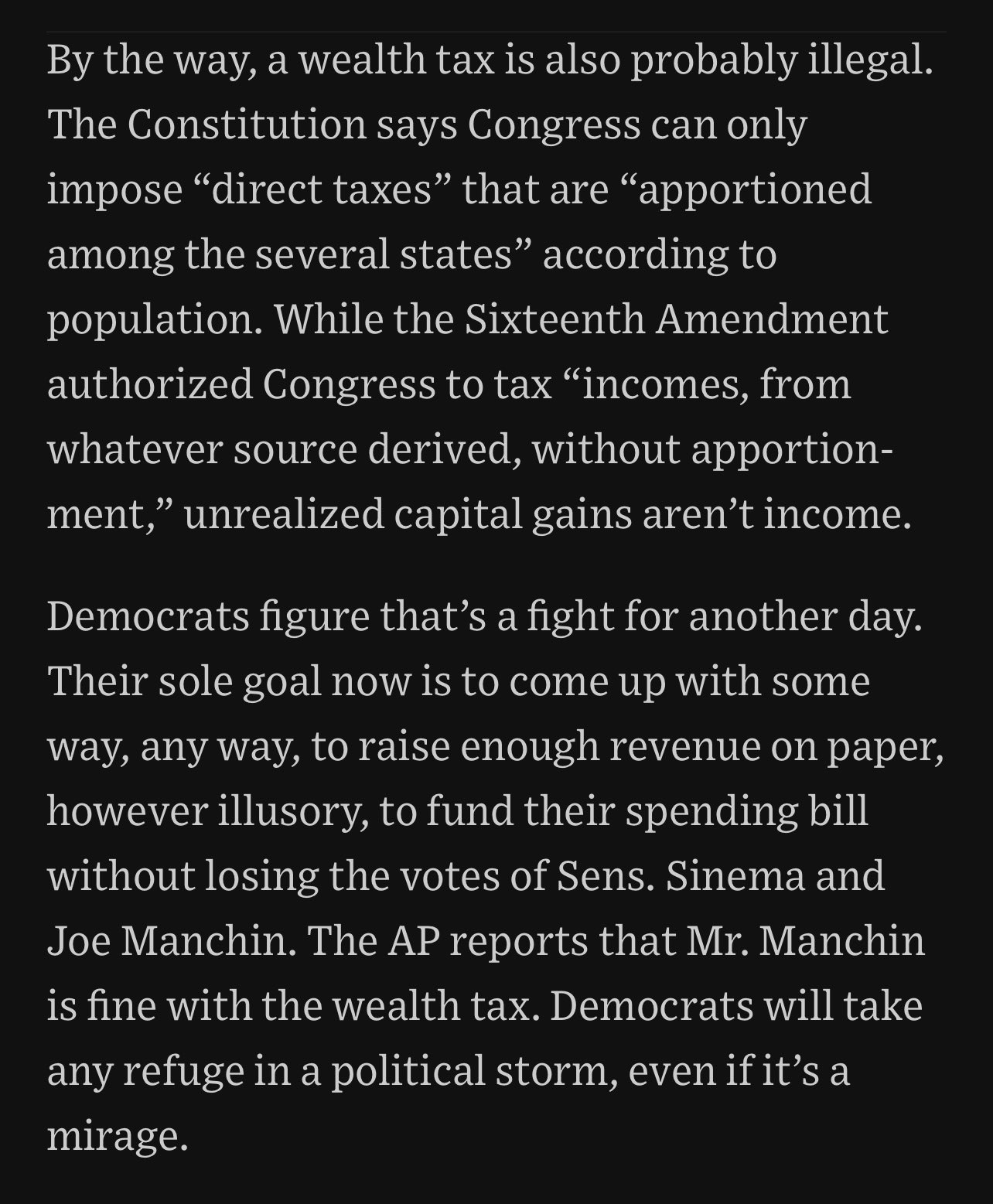

The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of the sale of the asset. In sum the Democrats proposed new tax on unrealized capital gains is likely an unconstitutional wealth tax and if it passes the Treasury may find itself forced to spend. In practice it would be an unworkable and arguably.

Democrats proposed funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per year or. But few if any independent surveys delve into the question of taxing the unrealized gains of billionaires. The Biden administrations idea to tax billionaires unrealized.

The billionaires tax cant be ruled unconstitutional unless it has first. An attempt to tax unrealized capital gains was struck down in the Macomber case of 1920. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional.

A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. The presidents new budget plan calls on Congress to tax wealthy Americans.

The tax that the left wants to impose on the rich. The courts will decide if this goes forward but the idea is dubious at best. Washington Post columnist Henry Olsen explains why this is not only a terrible idea but also unconstitutional.

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates. Legal obstacles loom for Democrats. An income tax is the obvious example and indeed income taxes were held unconstitutional until we ratified the 16th Amendment.

It will likely be challenged in court as unconstitutional. Every other tax that has been challenged on these grounds has been upheld. The Biden administrations idea to tax billionaires unrealized capital gains may sound good to the tax-the-rich crowd.

Nobody likes to pay taxes. It Could Be Unconstitutional. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital.

But is there income before gains are realized. The Democrats plan to tax billionaires unrealized capital gains has a problem. Likewise a tax on unrealized capital.

The proposal taxes unrealized gains. If youre single and all your taxable income adds up to 40000 or less in 2020 then.

A Wealth Tax Is A Good Idea If We Had A Different Supreme Court The Washington Post

Capital Gains Tax Obviously Unconstitutional Editorials Union Bulletin Com

The Biden Administration S Cynical And Unconstitutional Proposed Tax On Wealth

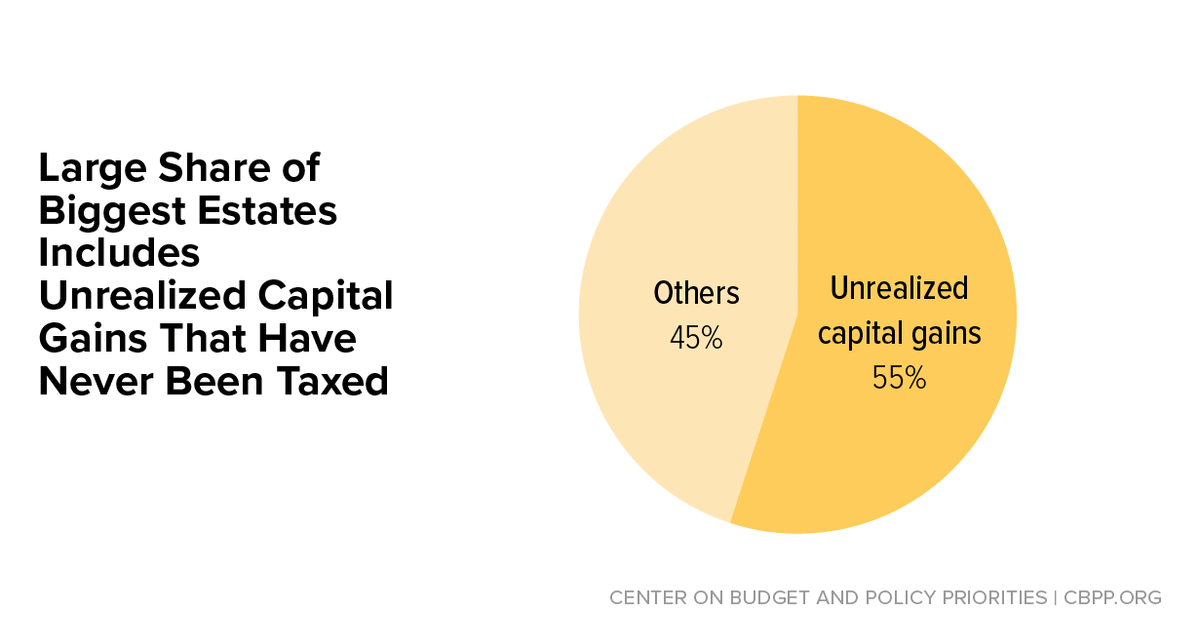

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

What Income Taxes Do Seattle Residents Pay Quora

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Digging Further Into The Question Is Taxing Unrealized Gains Constitutional Mish Talk Global Economic Trend Analysis

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only

Challenge To Washington S Capital Gains Tax Can Move Forward Judge Rules The Seattle Times

Would A New Billionaires Tax Be Constitutional Politico

Recent Articles Law Offices Of David L Silverman 2001 Marcus Avenue Lake Success Ny 11042 516 466 5900 Page 20

There Are Very Good Reasons Why No Nation Has Ever Tried To Tax Unrealized Capital Gains

The Trouble With Unrealized Capital Gains Taxes The Spectator World

The Left S Flirtation With Capital Gains Taxes Ignores The Fact That They Re Unconstitutional Freedom Foundation

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Billionaire Tax Faces Likely Constitutional Challenge Wsj

![]()

Taxing Unrealized Capital Gains The Crazy Fed Proposal To Tax Profits That Don T Exist Scottsdale Bullion Coin